“Nexus Mutual's coverage dynamically adjusts the cover amount as more ETH is staked to reflect the change in risk. Deductibles will be paid by either the responsible node operator or the Slashing Coverage Treasury. Nexus Mutual provides dynamic umbrella coverage up to 2.0 ETH per validator, and the deductible is assigned between the Node Operator Commitment and the Slashing Coverage Treasury, depending on the cause of the incident. How does slashing coverage work in different scenarios? Liquid Collective's Slashing Coverage Program is designed to mitigate the risks of both types of incidents. Slashing incidents may result from a node operator's specific fault/inaction as well as from network-wide events broadly (e.g., client bug, natural disaster).

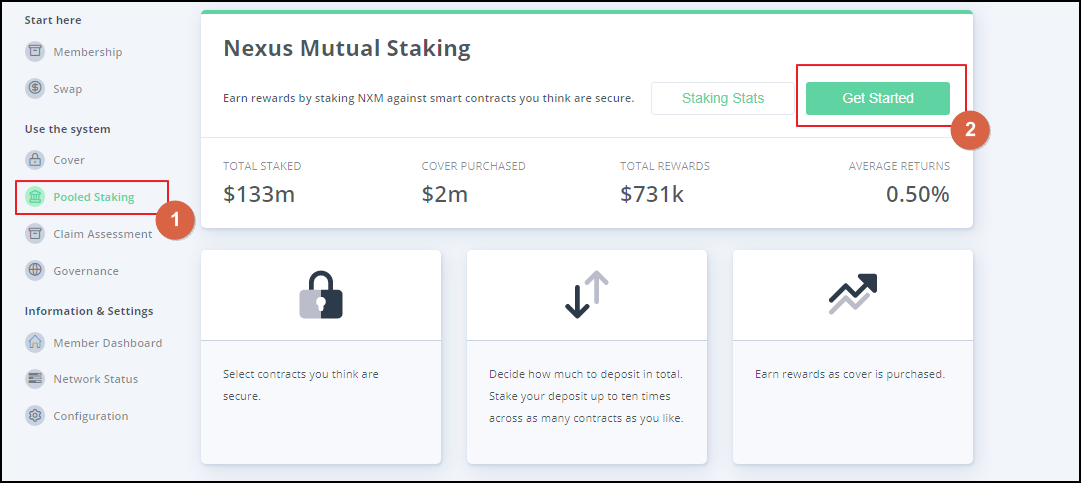

Through this unique collaboration, Liquid Collective - the liquid staking protocol built and run by a collective of web3 teams like Coinbase, Kraken, Figment, and Kiln - is providing all of the protocol's participants with comprehensive slashing coverage through a multi-tiered program focused on protecting against slashing events. © 2023.We're thrilled to announce the launch of Liquid Collective's Slashing Coverage Program in collaboration with Nexus Mutual, a prominent industry leader that provides decentralized crypto-native protection. All loans are provided by Beyond Bank Australia Ltd ABN 15 087 651 143, AFSL/Australian Credit Licence 237856. You should consider whether it is suitable for your circumstances before acquiring this product. This information has been provided without taking into account any of your objectives, financial situation or needs. The FSG will be provided at the time of acquiring the product. Please review our Financial Services Guide (FSG) available on our website at by calling us on 13 25 85 to request a copy or by visiting a branch. Costs (such as redraw fees or early repayment fees) and savings (such as fee waivers) are not included in the comparison rate but may influence the cost of the loan. Different terms, fees or other loan amounts might result in a different comparison rate. WARNING: This comparison rate is true only for the example given and may not include all fees and charges. *The comparison rate shown is calculated for a $150,000 secured loan repaid monthly over a term of 25 years. This offer is available for a limited time only and may be varied, withdrawn, or replaced at any time in Beyond Bank’s sole and absolute discretion. The following products are excluded from this offer: Parent equity, bridging, Land Rent Scheme, interest-only, investment, and building/construction loans. Offer only applies to new loans, or loan increases, applied for on and from 24 October 2022. The interest rate displayed for the Purple Basic Variable Home Loan is available for new loans with a minimum borrowing amount of $150,000 or increases to existing loans where the increased borrowing amount is $50,000 or more and, in all cases, where the LVR does not exceed 70%.

#Nexus mutual full

Full details are available on application. ^Terms and conditions, fees and charges, eligibility and lending criteria apply.

For deposits of $2,000 to $5,000,000 based on interest paid at maturity. Special 7-month term is available from 13 December 2022 and is available for a limited time only and may be withdrawn at any time.

Terms, conditions and eligibility criteria apply, including minimum lending amounts.īorrowers who acquired or applied for these products before this date may have a different interest rate.ġInterest on all term deposits is calculated daily on the whole balance in the account and paid into a Beyond Bank savings account of your choice. Interest rates are applicable to new loan applications received from 16th May 2023 and are subject to change without notice.

0 kommentar(er)

0 kommentar(er)